mstr stock: Bitcoin Retreats and Corporate Risk

Is MicroStrategy a Genius Bet on Bitcoin's Future, or a House of Cards?

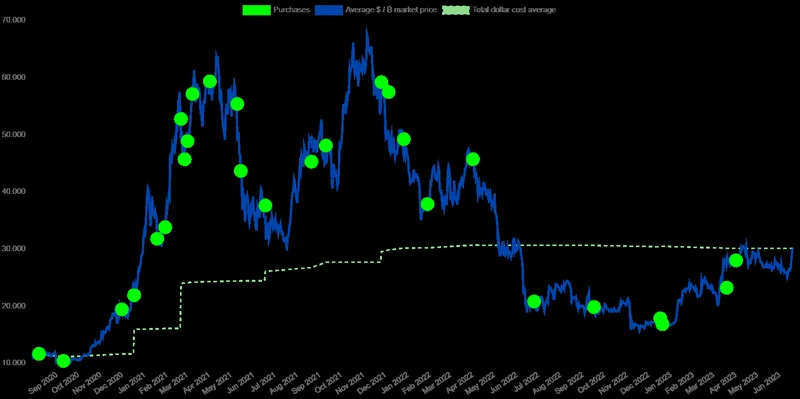

Okay, let's talk MicroStrategy (MSTR). This company, once a fairly quiet software player, has gone all-in on Bitcoin, transforming itself into the world's largest corporate holder of the cryptocurrency. Now, with the stock down 40% in the last six months, and some analysts whispering "sell," the big question is: are they crazy like a fox, or just plain crazy?

I've been watching this story unfold with fascination, and honestly, a little bit of nervousness. Michael Saylor’s strategy of continuously buying Bitcoin has been called everything from visionary to reckless. But let's cut through the noise and get to the heart of it: is this a long-term game, or are we watching a bubble about to burst?

The headlines aren't exactly encouraging. We're seeing reports that MSTR's stock price has dipped below the value of its Bitcoin holdings – that's a rare "negative premium," folks, and it suggests the market is seriously questioning the company's operational risks and financing structure. Ouch. Strategy (MSTR) Stock Dips Below Bitcoin Holdings Value Amid Mar

But here’s the thing: markets are often short-sighted. They react to immediate pressures, to the daily dips and dives. They don’t always see the bigger picture. And the big picture here is that MicroStrategy isn’t just holding Bitcoin; they're building an entire strategy around it.

MicroStrategy is raising dividends on preferred shares to 10.5% to revive demand. They are also looking into international markets and considering ETFs backed by their preferred shares. It's like they are building a financial ecosystem around Bitcoin, and that requires a level of foresight that most companies simply don't possess.

A New Kind of Company

I see MicroStrategy as something fundamentally new: a hybrid entity, part tech company, part Bitcoin treasury. This isn't just about holding an asset; it's about integrating it into the very core of their business model. They're not just betting on Bitcoin’s price going up; they're betting on Bitcoin becoming the foundation of a new financial world.

Think about it: What if Bitcoin does become the dominant global currency? What if it becomes the standard for digital transactions? MicroStrategy, in that scenario, would be sitting on a goldmine – a literal digital goldmine.

Of course, there are risks. The company's debt is skyrocketing. In 2023, total liabilities were $2.598 billion. Last year, the amount grew to $7.614 billion—a 193% increase. The constant issuance of new shares to buy more Bitcoin is diluting shareholder value, and that's a legitimate concern. But what if that dilution is a short-term pain for a long-term gain? What if those shares become incredibly valuable in the future?

Strategy is now exploring international markets and considering ETFs backed by its preferred shares. It also plans to launch its first euro-denominated preferred share, expecting $715 million in proceeds.

And let's not forget the analysts. Despite the recent turmoil, the consensus is still surprisingly bullish. Out of 15 analysts covering MSTR stock, 12 recommend “Strong Buy.” The average MSTR stock price target is about $523, indicating an upside potential of over 120% from current levels. Now, analysts aren't always right, but that level of optimism suggests that there's something more here than just hype.

This reminds me of the early days of the internet. Remember when everyone thought Amazon was crazy for selling books online? Remember when people said Google was just another search engine? Sometimes, the most disruptive companies look the craziest at first.

When Strategy reported Q3 earnings on Oct. 26, it beat on both the top and bottom lines, posting GAAP earnings per share of $8.42 versus analysts’ expectations of $7.90 and revenue of $128.7 million, exceeding analysts’ expectations of $116 million.

The biggest risk, as I see it, isn't financial; it's ethical. With great power comes great responsibility, and if Bitcoin does become a dominant force, companies like MicroStrategy will have a huge influence on the future of finance. We need to make sure that influence is used responsibly, ethically, and for the benefit of everyone, not just a select few.

The Future Belongs to the Bold

Tags: mstr stock

JP Morgan and Epstein: Trump Demands Answers

Next PostKathy Ireland: Still Doing... Stuff?

Related Articles