Alright, folks, buckle up, because things are getting really interesting ov...

2025-11-18 1 ubisoft stock

Ubisoft's recent move to postpone its first-half fiscal year 2025-26 earnings report and halt trading of its shares and bonds has sent ripples – or perhaps tremors – through the market. The official reason, according to CFO Frederick Duguet's email, is the need for "extra time" to finalize the semester's closing. Legal regulations, he claims, prevent him from elaborating further. (Always a red flag when lawyers are involved.)

It's a textbook case of corporate opacity, and the market hates opacity. Daniel Ahmad of Niko Partners speculates on X (formerly Twitter, a useful but often unreliable barometer of sentiment) that a major announcement, possibly an acquisition or a financial issue, is brewing. The reality is likely more nuanced, but the optics are undeniably bad.

Let's rewind a bit. Ubisoft recently accepted a $1.25 billion "bailout" (a term they'd likely dispute, but let's call a spade a spade) from Tencent. The funds were then used to spin off a new entity, helmed by the CEO's son. This reeks of financial engineering, but the key question is why? What problem were they trying to solve? My analysis suggests they were trying to isolate their most profitable assets.

Enter Vantage Studios, the new subsidiary housing the crown jewels: Assassin’s Creed, Far Cry, and Rainbow Six Siege. Meanwhile, Ubisoft is reportedly looking to offload other franchises like Splinter Cell and Prince of Persia. This suggests a strategy of streamlining, focusing on core moneymakers, and shedding less lucrative ventures. The creation of Vantage Studios feels like a pre-emptive carve-out, a way to protect the "good" assets from the rest of the company's potential issues. Think of it like a lifeboat strategy: secure the valuables before the ship starts sinking.

But here's the rub: what happens to the developers not working on Vantage Studios projects? The announcement of voluntary layoffs across Swedish studios, including Massive (the lead studio on The Division), isn’t exactly reassuring. Are we looking at further cost-cutting measures? Potential studio sales to outside companies? These are the questions that remain unanswered, and uncertainty breeds fear – both within the company and among investors.

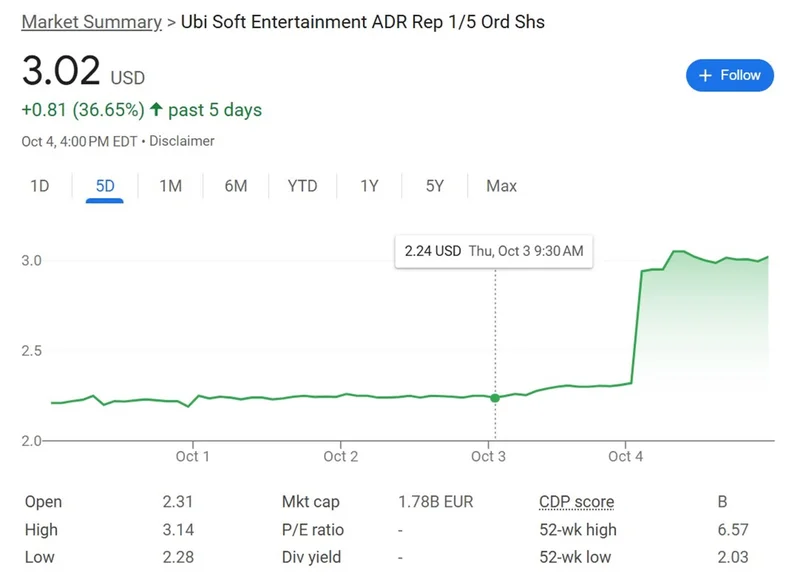

Ubisoft's stock price is currently at its lowest point in over a decade. That's not a coincidence. The market is voting with its feet. The share price is down approximately 60% from its all-time high (I need to find the precise number to confirm, but that's the ballpark). And this is the part of the report that I find genuinely puzzling. The market is clearly pricing in significant risk, despite the presence of Vantage Studios. Is there something the market knows (or suspects) that isn't being publicly disclosed?

Consider this: the creation of Vantage Studios, while ostensibly a positive move, could also be interpreted as a sign of desperation. It says, "Look, we know the rest of the company might be struggling, but these franchises are safe." But investors are rarely comforted by such compartmentalization. They see the larger picture: a company undergoing restructuring, facing potential cost-cutting pressures, and relying on a concentrated portfolio of IPs.

The halt in trading only amplifies these concerns. While it's possible that a positive announcement is on the horizon (perhaps a major partnership or licensing deal), the timing is suspect. Why delay the earnings report now, especially after the Tencent investment and the creation of Vantage Studios? What skeletons are they trying to keep in the closet, even temporarily? Ubisoft Just Did Something Extremely Weird - Kotaku

The delay and trading halt are expected to raise questions and drive media coverage. This is unavoidable. The longer Ubisoft remains silent, the more speculation will fill the void. Is Ubisoft genuinely facing a temporary accounting issue, as Duguet suggests? Or is this a symptom of a deeper malaise – a company struggling to adapt to the changing landscape of the gaming industry?

Ubisoft's actions speak louder than their words. The market has already delivered its verdict. The company's fate hinges on its ability to regain investor confidence, and that requires transparency, not obfuscation. The clock is ticking.

Tags: ubisoft stock

Related Articles

Alright, folks, buckle up, because things are getting really interesting ov...

2025-11-18 1 ubisoft stock