MP Materials Stock: Q3 Earnings and Rare Earth Volatility

Generated Title: MP Materials: Is This Rally Justified, or a Rare Earth Bubble?

The Rare Earth Rush: MP Materials' Ascent

MP Materials (MP) has been on a tear this year, surging over 250%. That's a performance that gets investors excited, naturally inviting comparisons to Nvidia (NVDA), the current darling of the tech world. The bullish argument hinges on scarcity: Nvidia dominates in AI chips, and MP controls a key U.S. source of rare earth metals. The comparison, however, requires a closer look at the numbers.

Nvidia's scarcity is driven by its technological lead in chip design. MP Materials' scarcity, on the other hand, is tied to its physical control over the Mountain Pass mine, one of the few scaled sources of rare earths in the U.S. It's a crucial distinction. One is built on innovation, the other on geography and geopolitics. The Trump administration's $400 million investment underscores the strategic importance of MP's role in reducing U.S. reliance on Chinese rare earth imports.

But let's dig into the financials. MP's market cap sits around $11 billion. To reach Nvidia's valuation, MP would need to climb roughly 44,900% from its current price. That's a tall order, to put it mildly, even for a company in a strategically vital sector.

Beyond the Hype: A Reality Check

Morgan Stanley maintains an "Equal-weight" rating on MP, with a price target of $68.50. Their analysis points to project execution risks and rare earth price volatility as reasons for caution. Is MP Materials stock worth owning amid rare earth volatility? MS weighs in By Investing.com forecasts EBITDA of $50 million for Q4 2025 (up 28% from previous forecasts) and projects normalized EPS of $0.12 for the same period. Looking further out, they estimate EPS of $1.24 by 2028. These numbers, while positive, don't scream "Nvidia-level growth."

MP's Q3 2025 results showed a 15% year-over-year revenue decline to $53.6 million. While the company beat earnings estimates (a loss of 10 cents per share versus an expected loss of 14 cents), the revenue dip is concerning. Record neodymium and praseodymium (NdPr) production is a bright spot, but the overall picture is mixed. The Materials segment's revenues declined 50% year over year to $31.6 million, offset somewhat by the Magnetics segment generating $21.9 million in revenue.

The consensus estimate for 2025 earnings is a loss of 23 cents per share, but the consensus for 2026 is earnings of 92 cents per share. That implies a significant turnaround, but it's still just a projection. MP Materials stock trades at a forward 12-month price/sales multiple of 16.67X, a significant premium to the industry’s 1.42X. MP’s Value Score of F suggests that the stock is not so cheap and a stretched valuation at this moment.

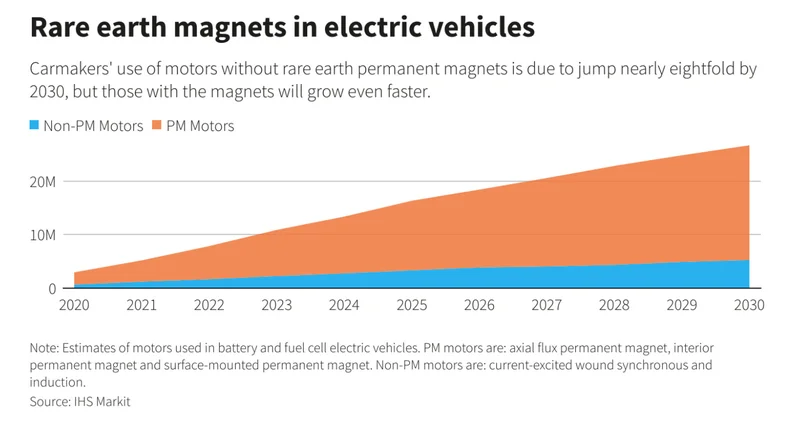

MP plans to begin commercial production of permanent magnets by the end of 2025. This is a key step in developing a fully domestic rare earth mine-to-magnet supply chain. However, Morgan Stanley's analyst, Carlos De Alba, cautions that "project execution is the biggest risk now." And this is the part of the report that I find genuinely puzzling. MP "has been delivering on its operating targets and has a strong balance sheet to support the downstream transition," yet project execution remains the biggest risk? This dichotomy warrants further scrutiny.

MP is also investing in a heavy rare earth separation facility at Mountain Pass, designed to process approximately 3,000 MT of feedstock per year. This facility will initially prioritize production of dysprosium (Dy) and terbium (Tb), with a nameplate capacity of 200 MT per year. This is crucial for MP's planned annual production of 10,000 MT of high-performance NdFeB magnets.

Is This Just Another Geopolitical Play?

MP's current rally feels less like a reflection of intrinsic value and more like a bet on geopolitical trends and government support. The company’s connection with the U.S. Department of Defense “has materially de-risked the company’s business model." That phrase carries a lot of weight. It suggests that MP's success is heavily reliant on government contracts and strategic considerations, rather than purely market-driven demand.

To be clear, there's nothing inherently wrong with this. Many companies benefit from government support. However, it does mean that MP's valuation is tied to political winds and policy decisions, which are inherently unpredictable. It's a different risk profile than a company like Nvidia, whose success is driven by its technological prowess and market demand for its products.

It's a Speculative Play, Not the Next Nvidia

Tags: mp materials stock

Mexico City: New Mission Leaders? Who Cares?

Next PostMSTR Stock: Price Surge and Bitcoin's Influence

Related Articles